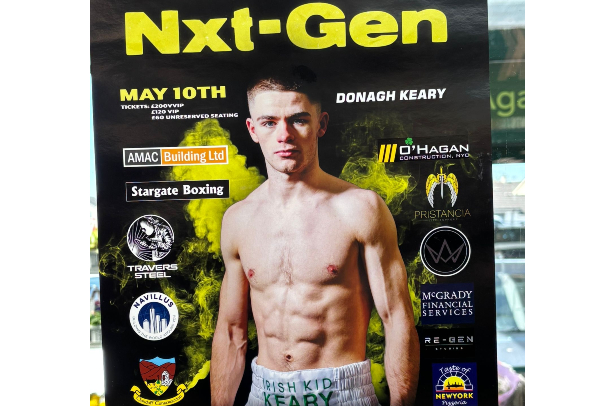

McGrady Financial Services are delighted to be able to sponsor Donagh Keary for his upcoming fight in Aberdeen this Saturday! From all the Staff at McGrady Financial Services, we wish you the very best of luck Donagh!

We are delighted to announce that we have achieved the renewal of our Cyber Essentials and Cyber Essentials Plus Certification. Cyber Essentials is a government backed scheme which is designed specifically to help strengthen UK business resilience. This involved a full technical audit of our systems against the Cyber Essentials Controls. Achieving this accreditation underpins […]

We are seeking an organised individual with a keen interest in financial services to join our dynamic team. The Office Administrator will handle various administrative tasks and assist in supporting the team of financial advisors. Benefits: Competitive salary Pension plan Opportunities for professional development and advancement Requirements: Experience: Previous experience in an administrative role […]

We were delighted to sponsor the “McGrady Financial Services Maiden Hurdle” at Downpatrick Race Course last week. The team had an absolutely fantastic day out, and thank you to everyone at Downpatrick Race Course for your hospitality!

We would like to say congratulations to our colleague Seamus Valente who has obtained a Level 3 Certificate in Mortgage Advice from the Chartered Insurance Institute. Seamus works as a Paraplanner McGrady Financial Services Ltd, and he also holds a Certificate in Mortgage Advice and Practice (CeMAP). This is a great milestone in Seamus’ continuing […]

We would like to thank our fantastic staff for their kind donations towards our 2020 Christmas Appeal. Their generosity has meant we are able to support Crisis Together for the Homeless and Action for Children. Well done and thanks to our staff for organising this!

McGrady Financial Services Ltd are delighted to announce the latest addition to our team, Wayne Whewell as a Financial Planner. Having worked in Banking since 1982 and in the Financial Services industry since 1992, Wayne has substantial experience in the sector. He joined St. James’s Place Wealth Management in 2013 as a Senior Partnership Development […]

In the interest of public safety and following most recent guidance, we will conduct all business by telephone or video conference going forward. We will support our clients throughout this difficult period in markets and their business trading, providing concise information regarding the support available. Our goal must be to prevent the unnecessary spread of […]

It’s currently business as usual here at McGrady Financial Services. We’re taking precautions as advised and have implemented protocols to address concerns around COVID-19. We’re making full use of technology with video calling & telephone meetings available for all our valued clients. If you‘ve any queries or would like to arrange an appointment, please contact […]

McGrady Financial Services were delighted to attend the recent Year 10 and Year 12 Careers Convention in St Malachy’s High School Castlewellan. Philip McCrickard (Managing Director) commented that “it was a fantastic opportunity to share our experiences and advice with the students of St Malachy’s High School. This is a key part of our social […]