McGrady Financial Services and M.B. McGrady & Co. Chartered Accountants are proud to announce their combined support of Olympian, Kerry O’Flaherty, one of Ireland’s best track & field athletes, in her latest journey to reach the Commonwealth Games 2018. In celebration of our partnership, Kerry will be delivering an inspirational ‘Breakfast with an Olympian’ seminar […]

Olympic athlete and track specialist, Kerry O’Flaherty pays a special visit to St Malachy’s Primary School Castlewellan. One of Ireland’s best track and field athletes, Kerry O’Flaherty, who competed in the Rio Olympics 2016, visited St Malachy’s Primary School, in Castlewellan, to deliver one of her ‘Inspire’ series of events, supported by local businesses, McGrady […]

The Prize Giving Evening for the McGrady Financial Services Junior XC Series was held in East Down AC’s Club Rooms on Monday 15th May 2017. Here at McGrady Financial Services, we are delighted to have been able to sponsor the again Series this year. We think that it is an excellent opportunity for children of all abilities to […]

McGrady Financial Services are delighted to sponsor Kerry O’Flaherty again this season with M.B. McGrady & Co Accountants. We wish her the very best of luck in her training at Font Romeu! Links from this website exist for information only and we accept no responsibility or liability for the information contained on any such […]

A very inspirational blog from Olympian Kerry O’Flaherty on her Olympic journey. We are delighted to play a small part on her fantastic journey! View the blog by clicking the link below: Links from this website exist for information only and we accept no responsibility or liability for the information contained on any […]

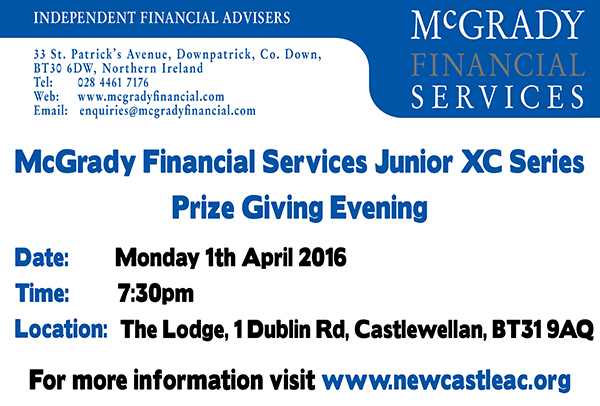

We are delighted to invite everyone that competed in the McGrady Financial Services Junior XC Series to attend a prize giving event at The Lodge Castlewellan. Date: Monday 11th April 2016 Time: 7:30pm Location: The Lodge Castlewellan 1 Dublin Road, Castlewellan, Co. Down, BT31 9AQ Links from this website exist for information only and we […]

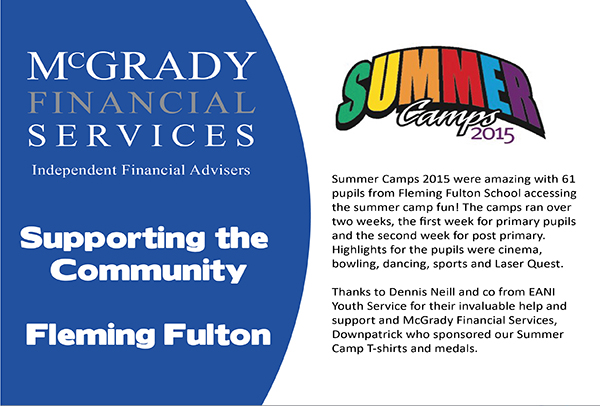

Have a look at an article from the ‘Fleming Fulton Today’ newsletter, where we sponsored t-shirts and medals for their annual Summer Camps Scheme. Links from this website exist for information only and we accept no responsibility or liability for the information contained on any such sites. The existence of a link to another […]

Great interview with Kerry O’Flaherty tonight on BBC Newsline. We’re delighted to see Kerry wearing our t-shirt – the excitement is building for Rio 2016! Links from this website exist for information only and we accept no responsibility or liability for the information contained on any such sites. The existence of a link to […]

McGrady Financial Services is proud to be teaming up with MB Mcgrady & Co Chartered Accountants and McGrady Insurance to support Kerry on her road to Rio! We wish her the very best of luck for the season ahead. Links from this website exist for information only and we accept no responsibility or liability […]