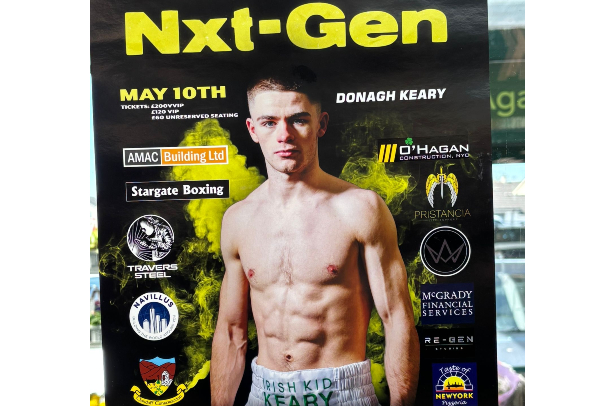

McGrady Financial Services are delighted to be able to sponsor Donagh Keary for his upcoming fight in Aberdeen this Saturday! From all the Staff at McGrady Financial Services, we wish you the very best of luck Donagh!

We are delighted to announce that we have achieved the renewal of our Cyber Essentials and Cyber Essentials Plus Certification. Cyber Essentials is a government backed scheme which is designed specifically to help strengthen UK business resilience. This involved a full technical audit of our systems against the Cyber Essentials Controls. Achieving this accreditation underpins […]