Our Vision

Our Services

Business Protection

Business protection is a way of helping to protect against possible financial losses in the event of the death or specified critical illness of a business owner or key individual, during the length of the policy.

Personal Risk Planning

Investment risk and personal tolerance to risk is fully explained and is key to making the right decision.

Estate Planning

Help ensure your personal possessions are passed on to the people you care about. With careful planning and expert advice, you could also reduce or eliminate potential tax liability.

Retirement Planning

When do you want to retire and how much income will you need? The use of Stakeholder, Personal Pensions, Self Invested Personal Pensions and Small Self Administered Schemes can help you plan for your retirement.

Tax Planning and Tax Mitigation

Tax liabilities could be reduced in a number of ways, including efficient Will* planning and the use of investment-based strategies within various Inheritance Tax mitigation schemes.

Investment Planning

Investments should be made in line with an overall financial plan, taking into consideration all aspects of your financial circumstances and objectives and making the most of tax-efficient savings allowances.

Personal Protection Planning

How much money would your family need to maintain their current lifestyle if you were diagnosed with a critical illness or died prematurely?

Life Long Financial Planning

Tailored to address your short, medium and long term financial needs and aspirations.

Auto Enrolment

Complying with the Workplace Reforms is one more requirement for employers. We provide small to medium sized businesses with an end to end solution for Auto Enrolment Pensions.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

The levels and bases of taxation and reliefs from taxation can change at any time. The value of any tax reliefs depends on individual circumstances.

* The writing of a Will involves the referral to a service that is separate and distinct to those offered by St. James’s Place. Wills are not regulated by the Financial Conduct Authority.

Advice in relation to Auto enrolment is not regulated by the Financial Conduct Authority.

Latest News

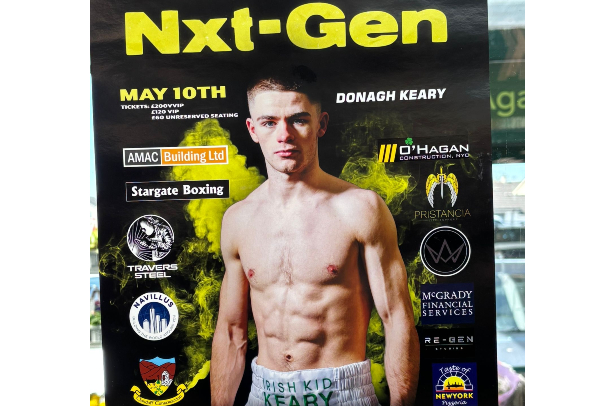

Proud Sponsors of Donagh Keary

McGrady Financial Services are delighted to be able to sponsor Donagh Keary for his upcoming fight in Aberdeen this Saturday! From all the Staff at McGrady Financial Services, we wish […]

Cyber Essentials Plus Certification

We are delighted to announce that we have achieved the renewal of our Cyber Essentials and Cyber Essentials Plus Certification. Cyber Essentials is a government backed scheme which is designed[…..]